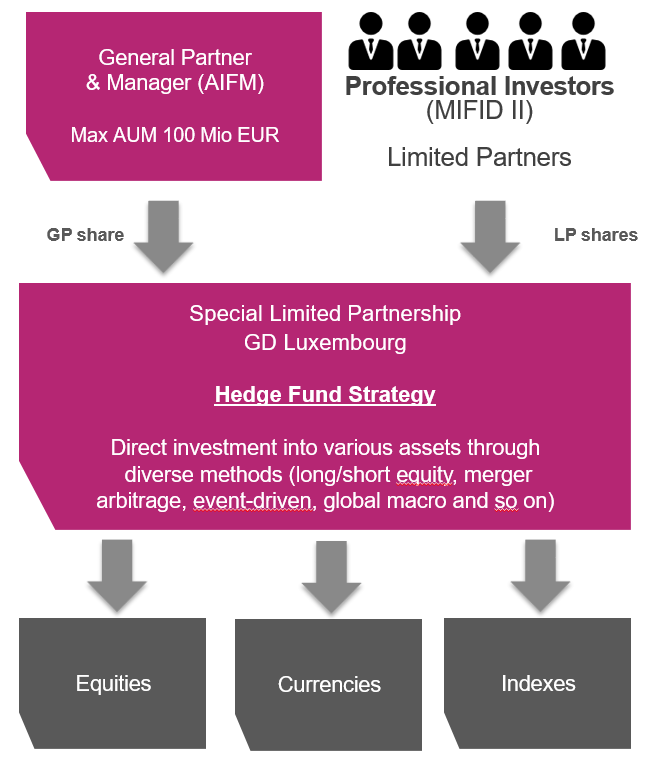

Hedge Fund

The hedge fund industry has survived the crisis of 2008 and has performed very well within the COVID-19 pandemic period. HF managers have now positioned themselves in the low-interest environment. Many AIFM’s have adapted their strategy, sometimes their fee schedule, and many investors have adapted their return expectations.

The future of the hedge funds are more and more dependent on high-frequency trading, artificial intelligence-driven, not only in finding new trades but also adapting new strategies to the ever-changing environment can select from a variety of different structures suited to their needs.